- January 27, 2023

- Posted by: Kusumi

- Category: Articles

2022 was indeed a busy year for the Aruwa Capital Management team and here is our inaugural year in review.

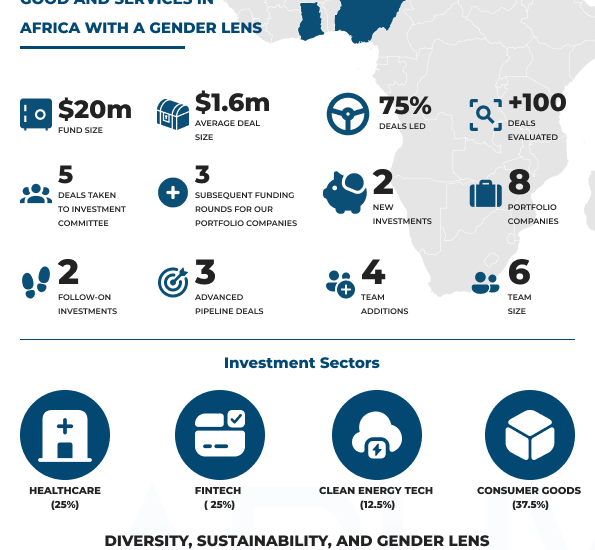

The Aruwa team was not the only aspect we expanded in 2022, we also increased the companies in our portfolio from 6 to 8.

We completed 2 new investments in 2022 and have 3 more in advanced stages of the pipeline. We led 75% of all deals in our portfolio with an average ticket size of $1.6 million.

We are pleased to see that 3 of our portfolio companies had subsequent funding rounds following our initial investment validating our competitive market positioning.

We did 2 follow-on portfolio investments which were both led by Aruwa, and we were very glad to close our $20million oversubscribed fund with the backing of global institutional investors.

Our unwavering focus remains, to invest in rapidly growing companies that provide essential goods and services to the rapidly growing female economy or businesses that are founded or co-founded by women or have gender diverse teams. 62.5% of our portfolio have female founders or women in leadership positions and 87.5% are local and indigenous founders. We will continue to put our money where our mouth is and can already see the competitive advantage through strong financial returns and positive social impact.

We look forward to a productive year and are grateful for all we achieved in 2022 and excited for what’s coming in 2023.

Thank you to our investors, portfolio companies, investment committee, advisory board and team for making it all possible.