- February 28, 2024

- Posted by: Kusumi

- Categories: Articles, Conferences

Planning for Successful Exits and Performance

The 2023 PEVCA Nigeria conference marked another milestone in the realm of private equity and venture capital in Nigeria. This year’s theme, “The Next Frontier: Private Capital Opportunities in a Shifting Economic Landscape,” featured a wide range of significant discussions in the Nigerian venture capital and private equity spaces. Aruwa Capital Management was proud to be a sponsor of this significant event.

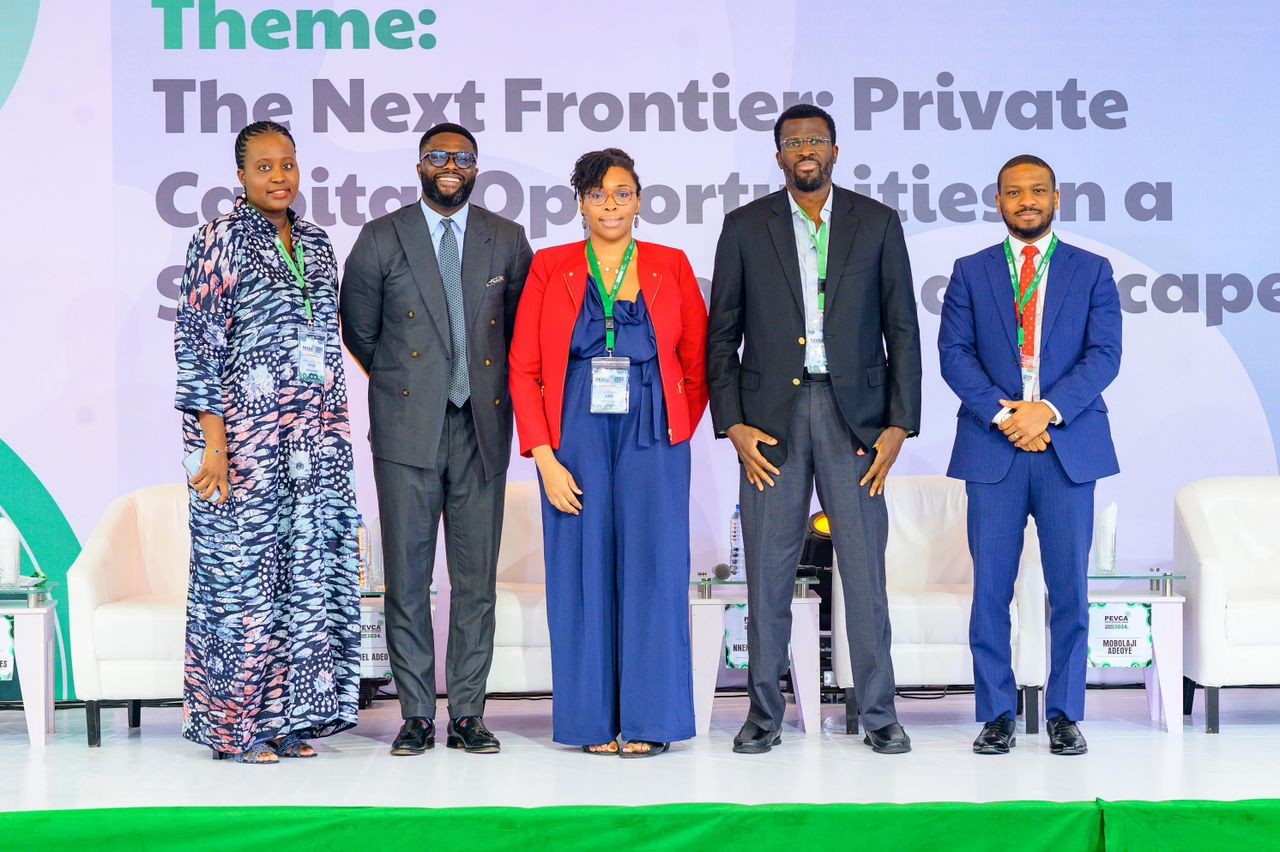

Our Founder- Adesuwa Okunbo Rhodes had the pleasure of moderating one of the panels themed: ‘Planning for successful exits and performance’ alongside esteemed panelists namely Nnennia Ejebe , Partner Adenia Capital, Laolu Alabi , Senior Vice President African Capital Alliance, Mobolaji Adeoye, Founder and Managing Partner, Consonance Capital and Daniel Adeoye, Partner Verod Capital.

The panel offered valuable insights on a range of topics, from the importance of proactive exit planning to navigating the complexities of the African and Nigeria market.

Some key insights from the panel include:

- Proactive Strategies, Early Planning for Long-Term Success

One key takeaway was the emphasis on adopting a proactive approach to exits. The panel stressed that successful exits are not coincidental, but rather from preconceived strategies that capitalise on opportunities when they arise. This proactive stance calls for starting exit planning concurrently with the development of the investment thesis at the initial stages. By adopting a forward-looking approach, private capital firms can ensure alignment with long-term objectives and maximise the potential for successful exits.

2. Navigating complexities in the African market – Innovation is critical

During the session, the speakers also acknowledged the unique challenges and opportunities presented by the Nigerian and African market. One point raised was the potential benefit, in certain cases, of holding a controlling stake in a company. This can provide greater control over the timing and structure of an exit. The panel also spoke on the need for flexibility in holding periods, given the inherent volatility of the African market especially with regards to local currency fluctuations. This calls for innovative fund structures, with the understanding from LPs to be able to extend holding periods when necessary. The discussion touched on the suitability of traditional fund structures within the Nigerian context. While traditional 10 year fund structures still hold relevance, the panel emphasized the need for adaptability and innovation to cater to the evolving needs of the market. Ideas came up regarding local currency funds or permanent capital vehicles to address the nuances of the Nigerian market.

3. Emerging Trends in the Industry

In addition to the trends of successful exits, the session explored several other relevant trends and considerations:

· Recent secondary transactions: Some recent successful secondary transactions were discussed, including the purchase of Medallion by Digital Realty (Consonance Investment Managers), iFìtness by Verod (Cardinal Stone) and Mauvilac by AkzoNobel (Adenia). These examples showcase the growing secondary market activity in Africa and its importance in showcasing a vibrant ecosystem that produces exits for investors.

· Exit strategies for the future: The panel also touched on various exit strategies being employed by GPs, including the use of self-liquidating instruments and redeemable preference shares. Verod cited the exit of UTL (Union Trustees) the MBO as a great example of a successful share buyback from management from a female founded company.

· Mitigating currency risk: In times of volatility, GPs are looking to strategies such as natural hedges and companies that encourage import substitution within the portfolio to mitigate against currency risk.

· Non-financial metrics in volatile markets: The panel also highlighted the importance of monitoring non-financial metrics in times of currency volatility such sales volumes, gross margins, and strong growth narratives when evaluating potential investments or monitoring portfolio companies as these metrics show a holistic picture of the company’s underlying value especially in volatile markets.

· Priority sectors: Some sectors highlighted by the panel that may pose a higher chance of exiting include but are not limited to- essential services, real assets, and import substitution plays.